Route of the US $ 10 billion man

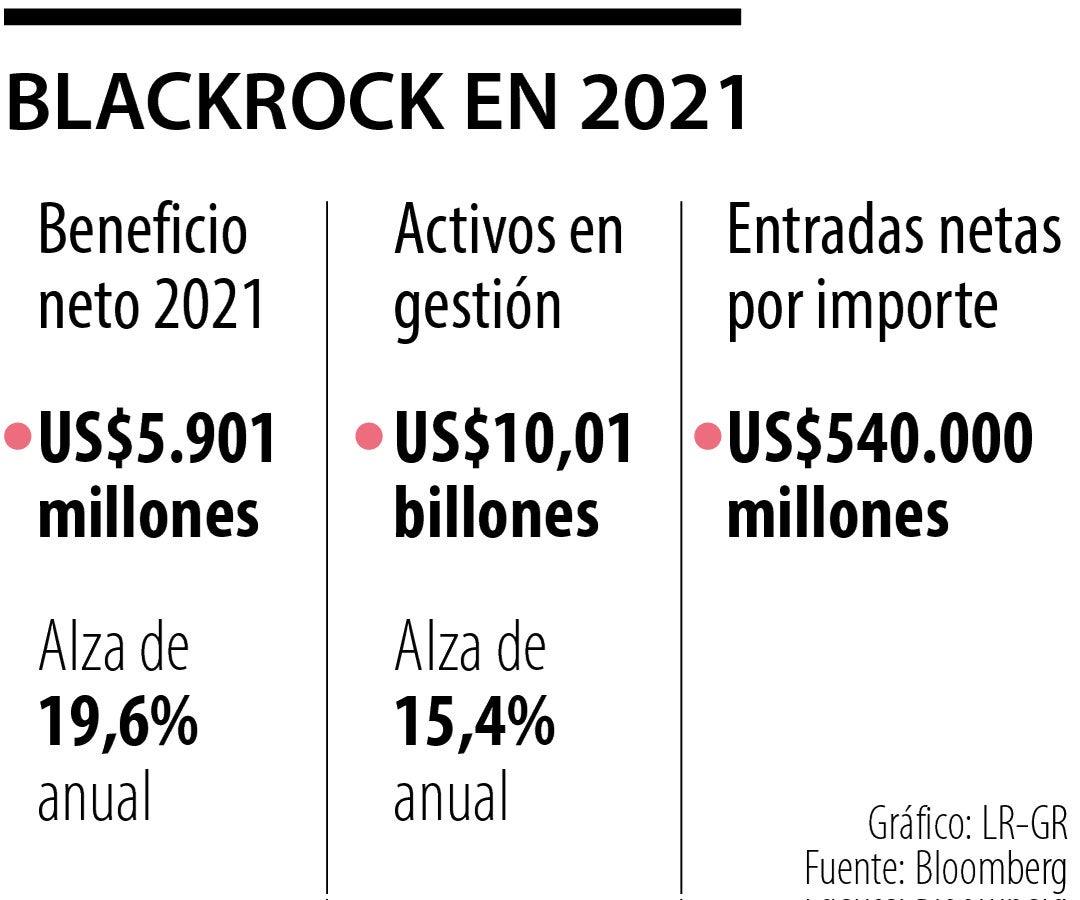

For the great global investors, the year only begins when Larry Fink, (founder in 1988 of the world's largest investment fund manager, Blackrock), publishes its road map for the next 12 months.Let's start by telling that Fink manages the equivalent of the sum of the three largest economies in Europe: Germany, France and Great Britain, about US $ 10 billion, and that when he points out a new business or a trend, global capitals move.

For this 2022, its letter has a high social load and with tufillo to pandemia, because of sustainability always speaks.“No relationship has changed more for the pandemic than that between employers and employees (...) Workers who demand more of their employers are an essential characteristic of effective capitalism.It drives prosperity and creates a more competitive panorama for talent (...) Companies that do not adapt to this new reality and do not respond to their workers at their own risk (...) The labor disruptions that are causing new capital sources, while the exponential growth of countries brings risks and opportunities for both investors and companies (...) Means that banks are no longer the only guardians of financing (...) There has never been more money available for new ideas to become a reality.This is feeding a dynamic innovation panorama ”.

How tovoid getting a divorce:

— medusa Thu Dec 10 11:33:25 +0000 2020

Some faithful followers of its epistolary gender criticize that its prospective of each new year is recharged more than social dogmas that are difficult to solve, a kind of political or ideological agenda, which affects the investments, to which the founder of Blackrock replies that it is nota social or ideological agenda.It is not ‘woke’, nothing to do with the different movements against social injustices, very fashionable in the United States these days.

“It is capitalism, promoted by mutually beneficial relations between you and employees, customers, suppliers and communities on which your company depends to prosper.This is the power of capitalism ".These days disruptive for large Colombian companies, it recommends that the CEO of companies positioned in the market, that they have to quickly adapt to this changing panorama and the diversity of capital available if they want to remain competitive in front of smaller and agile firms or playsstrategic.

He also raised the challenges that bring to capitalism the new demands of sustainability and the growing power of investors with the right to vote in MSG management matters (environmental, social and governance).“The majority of stakeholders, from shareholders to employees, clients, communities and regulators, now expect companies to play a role in the decarbonization of the global economy.Few things will affect capital allocation decisions more, and therefore the long -term value of your company, than the effectiveness with which to navigate the global energy transition in the coming years ”.Last year, Blackrock raised US $ 540.000 million with Ishares, a kind of new funds that are redefining the cause of money to emerging markets and especially the type of businesses that seek investments.